In May 2015, Google announced a flurry of new ad formats emphasizing what it called “moments” and officially launched them today. Amidst this, it also launched what are dubbed automotive ads – a rich, immersive ad format that has been showing up with increasing frequency over the last few months and almost certainly will impact how you need to think about your mobile search ad architecture and spend. Note that this article is less about the formats themselves (which have been talked about for a while) and more about the actual impact it will have on how you construct and allocate your search budgets.

In order to best understand this, we’re going to break this article into a number of parts – The format(s), the predicted impact and finally a few ways to think about your campaign strategy.

The Ad Formats that you need to look out for:

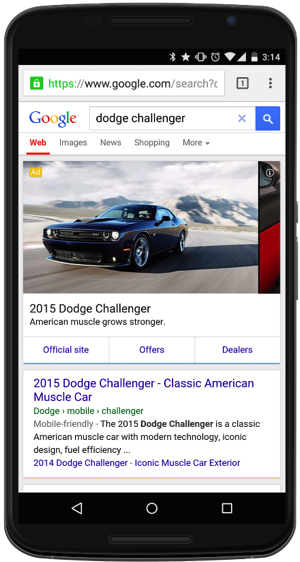

Automobile Ads: It appears the format triggers primarily on mobile devices for specific query types namely “make model” and “year make model” terms. At this point, it seems to be limited to certain OEMs, Makes and Models but it’s an important trend to watch for as explained later. Automobile ads seem to have 4 key components. The first being the ability to scroll and view images of the car, the second the ability to go to the official OEM site, the third to go to an offer specific section on the OEM site and lastly the ability to search for OEM dealers, which essentially triggers another search for “Make Dealer”. It is this last portion that, as dealerships and agencies serving dealers need to be most cognizant of.

Dealership Ads or DLA Ads: Dealership or DLA ads are triggered largely based on regional or franchise terms combined with the word dealer or dealerships. For instance – “Toyota dealer”, “Toyota dealership near me”, “Toyota dealer Yonkers” et al. It emphasizes 3 things – the name, a click to call button and a directions button all linked to your ad extensions.

What the data suggests:

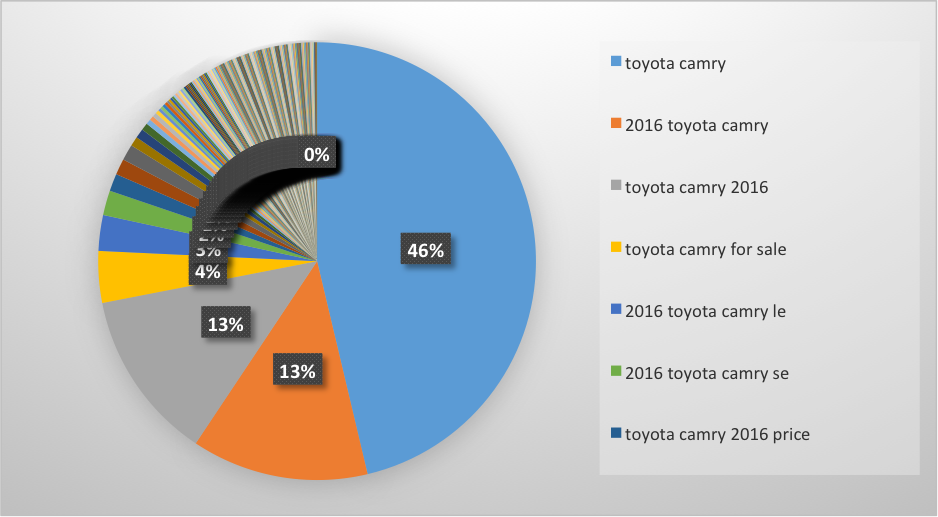

Before we gaze into the crystal ball, let’s talk hard facts – take the most important model on your lot. If you’re a Toyota dealer, likely the Camry. If you’re a Honda dealer say the accord and so on and so forth. What keywords are you buying to promote these? My guess is something along these lines – “Toyota camry”, “new Toyota camry”, “new camry”, “camry”, “2015 toyota camry”, “2016 toyota camry” and other longer tail searches “ toyota camry price”, “Toyota camry lease” et al.

Let’s now analyze the distribution of which of these keywords are searched on and clicked on more often than the others and what % of your spend goes there. You can do this by looking at your search terms report or asking your vendor to produce the relevant keyword data and run a similar analysis. For us (and I can bet for a lot of others) it will begin to look something like this. Let’s take a sample dealer that spends close to about $15,000 a month in an urban metro market like Washington DC and look at data over the last 6 months. We’re going to look at this two ways, first, how consumers shop for Camry’s and second, what your cost distribution looks like for similar keywords. (We’ve studied this over other accounts and the distribution is similar).

How consumers search for Toyota Camry’s:

How campaign and cost distribution takes places across ad groups:

So what can you expect next?

As you can tell, consumers are overwhelmingly likely to search for “Make Model” or “Year Make Model” while looking for a new Camry (which also reflect on your campaign cost and distribution). Note that this holds true for other models as well, we just isolated it to Camry for this article. Which means your campaign strategy needs to adapt in two ways – the potential loss in traffic from these terms and adapting and moving budgets to make up for that traffic.

It would also be very interesting to see how this impacts third party sites such as Autotrader, cars.com and everyone else that could potentially see traffic being driven away as more searches are contained within the Google ecosystem.

One way or another there will be a shift in the way you’re going to see users reach you on Google and it’s important that you’re ready for this shift.

Key Takeaways

- Analyze your traffic data or ask your vendors to do so for you. Look specifically for how much traffic you get from make model or year make model searches and understand how much of your spend or traffic is at risk. If your vendor is unable to do this for you – shoot us a note and we’ll be happy to do an analysis for you.

- While this may be rudimentary, a lot of vendors miss setting up ad extensions. The format will rely heavily on ad extensions and it’s therefore critical that you have your call, location and sitelink extensions set up at the bear minimum.

- Segment and build campaigns in a manner that allows you to have sufficient budgets and bids for terms that will drive traffic in the future.

If you’d like to chat with us further about this, contact us via the form on this page or shoot us a note at ppc@dealeron.com