Google recently confirmed a major shift in how ads display on desktop searches for commercial queries. We thought we’d share some insights on how we think this might impact dealerships who spend ad dollars on pay per click (PPC) advertising.

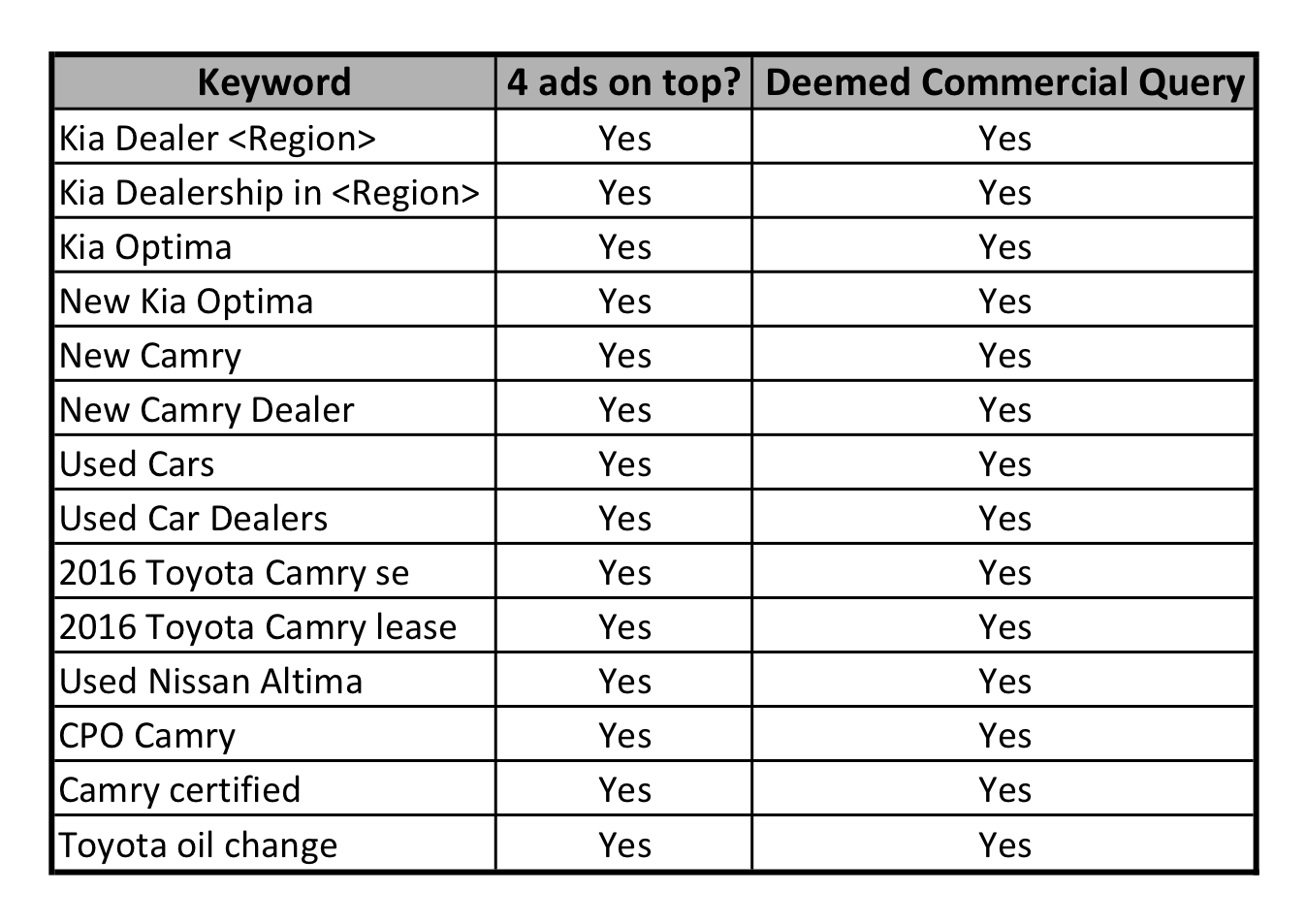

- First, let’s define “commercial queries” for car dealers: Per Google, these are keywords that show a heavier commercial or shopping intent. We ran a quick test and found almost all major keywords a dealer should buy have moved to the new format and are treated as “commercial queries”

Lower Supply + Stable Demand = Likely higher Cost-Per-Clicks: The simple facts here are that for each Google search, there are now only 7 ads can appear on the first results page, as opposed to the previous 11. Basic economics dictates that if there is less supply (4 less ad placements available), and the same demand (the number of cars manufacturers are producing isn’t going down because of this change), your actual cost-per-click is going to increase.

Lower Supply + Stable Demand = Likely higher Cost-Per-Clicks: The simple facts here are that for each Google search, there are now only 7 ads can appear on the first results page, as opposed to the previous 11. Basic economics dictates that if there is less supply (4 less ad placements available), and the same demand (the number of cars manufacturers are producing isn’t going down because of this change), your actual cost-per-click is going to increase.

- Google has always charged more for the ads on the top of the search results compared to the ads on the right-hand side. It is critical that you vigilantly monitor your Adwords performance in March to make sure that your cost per visit, lead, phone call and acquisition are not sent through the roof, destroying your budget.

- Your Bid and Budget Management tools/ philosophy just became that much more important: Both AdWords and tools like Kenshoo, Marin, Searchforce and Acquisio (depending on what your agency uses) offer a bid-to-position algorithm or a bid to CPA model. Most agencies have pivoted to setting a target for position 2 or position 3. You might actually find that bidding for position 4 gets you a slightly lower cost-per-click without impacting the volume and quality of traffic your ads generate. If your current provider does not use any bidding method or system – it’s high time you adopt one, otherwise, you are looking at a drop in traffic or being outbid regularly.

- Look at both your Average Position AND your Impression Share: Dealers that currently see their average position regularly in the top 3 may not have much to worry about. As we pointed out earlier, it might actually benefit you if your Quality score stays intact and your cost-per-click (CPC) drops should your ad move down to position 4.

- But don’t focus solely on ad position. Viewing ad position data in isolation can be dangerous. You need to look at your impression share as well to make sure that your impressions, clicks, visits, leads etc. aren’t being hurt by a lower average ad position. You might find over time that your ad position isn’t impacted much but your impression share is falling if your CPC’s rise if you don’t adjust your strategy. You don’t want to lose sales opportunities by focusing your Adwords strategy solely on Ad Position without also viewing Impression Share – this would be akin to missing the forest for the trees.

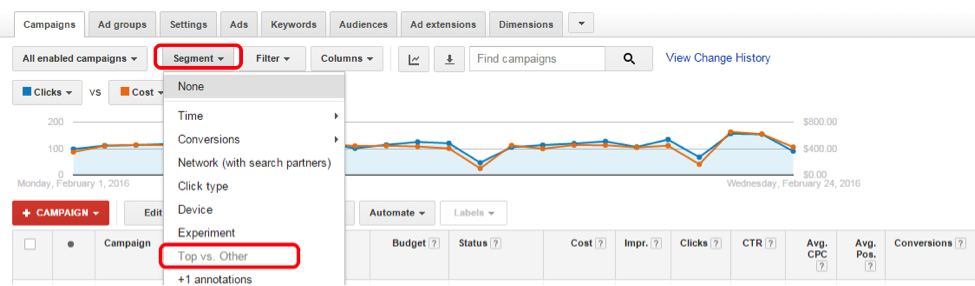

- Curious to see if you’re going to be seriously impacted? Use the top-vs-other segmentation in AdWords: The simplest way to see if you’re really going to be impacted is to segment your campaigns in AdWords by “Top-vs-Other” and measure what percentage of your ads are not being served in the top spots (prior to Feb 15th). If you find that a large percentage of your impressions (greater than 30%) are coming from “Google Search: Other”, you definitely need to adopt a slightly more aggressive bid strategy.

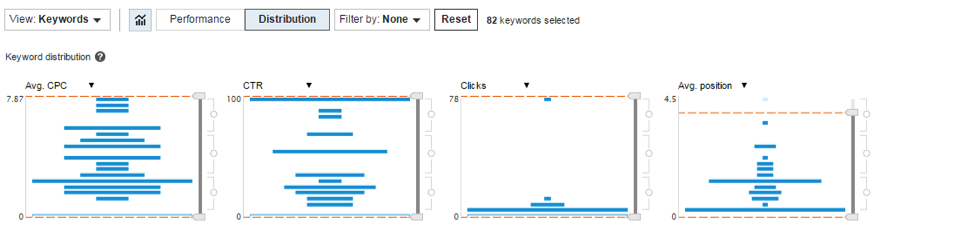

- Bing Ads as an indicator: Bing tends to be the after-thought in many instances, however, Bing has been showing 4 ads on the top of the SERP for the longest time and in this case might actually prove to be a treasure trove of data at least to glean cursory insights. If you’re running campaigns on Bing Ads, it might be a good idea to see how traffic flow and metrics vary at different ad positions (including position 4). To do this, the best way is to use Bing Ads keyword distribution graph option and filter down to see the difference in traffic and CTR at the various average position levels.

- Stay Calm and focus on mobile first, diversify later: There will be a lot of blog posts written by folks in the space, some that might even point you to spending larger chunks on Bing, Yahoo or Facebook Ads. In all the hype and hoopla don’t forget the single most critical factor to the future of your business – the world and your traffic is going mobile. If you’re watching your analytics data closely you’ve already seen a massive shift in traffic patterns (in the case of our customers, almost a 60:40 ratio between mobile and desktop).

- Google strategically moved to enhanced campaigns a while ago, anticipating this trend. Moving your advertising spend away from Google because some of the desktop traffic may cost slightly more would be a knee-jerk reaction that could waste a lot of money. Most dealers are already under-invested in Google’s mobile advertising, so rebalancing your Google Ad spend to focus more on mobile may actually provide better results than what you had before this change.

- Microsoft and Bing aren’t quite the masters of mobile yet, so it’s imperative that you maximize your efforts on Google (with an emphasis on mobile) and then diversify over time – remember — just because Google reduced the number of ads, doesn’t mean consumers are going to change their search habits. Your goal is to be where your consumers are, and Google’s share of mobile search is roughly 90%!

In conclusion, it’s important not to make hasty bid and budget decisions. No agency or in-house team has yet had a chance to collect a statistically significant sample size and form definitive conclusions about the impact of this change. We can only predict and estimate what the impact might look like. Our advice to dealerships is:

- Ask your SEM team about the impact. Have them show you the change within your metrics (CPC, Cost per Visit, Call, Lead, Acquisition, even Cost per Vehicle sold if your provider can track at that level—if they can’t give us a call!).

- Try testing different bid management approaches and have your vendor/ in-house team run a pre and post-optimization analysis. Dealers with small SEM budgets (less than $2500/month) need to be especially vigilant about how this change impacts their traffic patterns.

- Try investing more in Mobile Adwords Campaigns and see whether you can maintain or even increase your Cost per Acquisition by focusing more on where the consumer market is going.

We will be monitoring this closely across our own accounts and will publish more studies as a critical volume of data is available. Stay tuned!

If you’d like to chat with us further about this change, feel free to reach out to us at ppc@dealeron.com or send us your questions via the form on this page.

Great stuff Aurko. Always learning from you.